【新唐人2014年03月24日讯】有诸多迹象显示,中国楼市的繁荣期正在接近尾声。近来到访中国任何一个城市的游客,都会发现,那里有大量建造过多的楼房,这些所谓的“鬼城”,国际媒体认为是中国“楼市繁荣期即将结束的明显证据”。而大陆企业家分析,虽然中国的房地产泡沫越来越大,但是开发商、银行和政府会拚命维系,可是一旦房地产泡沫破裂,中共体制也将随之崩溃。

美国《华尔街日报》3月19号报导说,在中国北部工业城市哈尔滨,从机场进入市区的路上,可以看到郊区有大量“鬼城”,也就是遍布着大量空置高楼的社区。这些空置楼房成为了中国中产阶级不断增长的财富的归宿。在上海和北京这样的大城市,房价在2002至2012年间上涨高达五倍。

大陆企业家王瑛说,中国各个地方的房子供大于求,这是一个很普遍的现象。但是她认为,当局会千方百计的维系目前的状态,因为银行的钱和政府的钱都在这里面。

中国企业家王瑛:“银行把钱贷给了房地产商,房地产商把房子押给了银行。他们总是要千方百计的使这个链条不断,因为一旦断了的话,他们这些人的很多利益都会被砸在里头。因此他们不愿意让它断。实际上地方政府跟这个房子的关系是千丝万缕,所以房地产商、银行,加政府,他们之间会捆绑起来,来维持现有的这个房价。”

王瑛表示,过去三十年,中国的房子,实际上是社会财富重新分配的一个重要工具。

王瑛:“如果当年是打土豪、分田地,来实现了财产重新分配的话,这三十年,实际上最大范围内的财产分配的工具是房子。因为它不是按规则分配的。中国的很多人从无财产到有财产,有一点财产到有不少财产,他们实际上都是透过房子完成的。”

可是现在,中国的很多房地产投资出现了问题。今年1月份,全中国新建住房价格同比涨幅,一年来第一次放缓,成交量也在萎缩。

最近中共当局推出新规,要求处级以上官员登记房产。很多官员纷纷将手中的房产进行处理。

王瑛:“就说这些房子吧,实际上是很多官员拥有的财产,尤其是那些不能够摆到明面上的财产。所以这些人大概对房子的态度,包括他们是不是会继续按照原来的方式拥有更多的房子,其实是影响中国的房地产市场的一个蛮重要的原因。”

而现在人们看到中国的房市泡沫越来越大,当局也很难找到办法来中断这个恶性循环。然而,王瑛指出,他们越是觉得这个危险排除不了,越会把各种各样资源向这里集中。

王瑛:“就特别像这有一个大堤,那边是大江大河,汹涌澎湃,可是堤内有他们的万亩良田。他们的良田不可能搬家,他们只好不断的把那个大堤往高里修。”

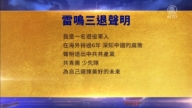

这个越来越大的房地产泡沫终究将有破的一天。王瑛表示,她无法预测是哪一天。但是,当那一天来临,那将是中共政权的一大劫。

王瑛:“我是觉得房地产泡沫的崩实际上是这个体制的一个大劫。房地产泡沫一崩,这个体制就再也无法维持下去了。中国的房地产泡沫,已经包含了这个体制几乎全部的内容。因此你让我预期房地产泡沫什么时候崩,几乎就是让我预期中国现在的这个体制什么时候会坍塌?我说我现在做不出判断。”

美国华裔作家章家敦曾说,中共领导人在政治上有不安全感,所以他们痛恨经济下跌。由于他们有资源和权力避免市场修正,所以他们就这么做。但也因为如此,积累的不平衡就越来越大。但是积累的不平衡变大以后,最终无法避免的房市崩盘就将变得非常严重。

采访编辑/秦雪 后制/李智远

Doom to the Party: The Collapse of China’s Housing Market

Many indications that the Chinese real estate

boom is nearing an end are showing themselves.

Tourists who visit any Chinese city will find an excessive

amount of newly constructed houses,

resulting in ghost towns.

These so-called ghost towns are regarded by foreign

media as clear evidence that the housing boom

is coming to an end.

A Chinese entrepreneur said despite China’s swelling

housing bubble, the Chinese Communist Party (CCP)

and its banks, as well as developers are desperately

trying to save the market.

However, once the bubble finally bursts, the CCP’s

regime will subsequently collapse.

The Wall Street Journal reported on March 19 that in Harbin,

an industrial city in North China, many ghost towns

are visible when heading downtown from the airport.

Ghost towns are mostly unoccupied communities

with many high-rise residences.

The truth is that much of the savings of China’s middle-class

were spent buying those houses.

In big cities such as Shanghai and Beijing, housing prices

have risen by five times between 2002 and 2012.

Wang Ying, a Chinese entrepreneur, said an excessive

housing supply is a phenomena seen all over China.

Wang believes that the CCP authorities will still try

their best to maintain the current situation

because the government and banks have invested

so much into the market.

Wang Ying: “Banks make loans to developers and developers

mortgage houses to banks.

Many local governments are also involved in such business.

Therefore the CCP officials make every effort to keep

that connection; otherwise all their interests will be lost.

In other words, they don’t want such an interest chain

to be cut off.

For this reason, developers, banks and governments form

an interest group to drive the current housing prices.”

Wang Ying commented that in the past three decades,

China’s housing market has been an important tool

of the Communist Party in redistribution of social wealth.

Wang Ying, Chinese entrepreneur: “The party used

to redistribute social wealth by killing landlords

and seizing their land.

In the last three decades, the housing market had become

the most important tool to do the same.

However, the redistribution did not follow rules

commonly understood by the public.

Chinese people never owned property for the purpose

of acquiring assets, and were unaware assets

could be acquired through owning a home.”

Currently, serious problems have developed with many

real estate investments.

This January, the price of new housing growth showed

a slowdown compared to last January, the first time in a year.

Meanwhile, the total trade volume also began to drop.

The CCP authorities recently issued new regulations requiring

officials higher than divisional-level to declare all property.

Consequently, many officials had to quickly

dispose of their houses.

Wang Ying: “For many officials, a large proportion

of their assets, especially concealed, are private houses.

The future attitude of this group regarding housing

purchases, will indeed impact China’s house market.”

Now, as the CCP authority finds it extremely difficult

to break the vicious cycle of the swelling housing bubble,

many people have taken notice.

Wang Ying believes that the more dangerous the party

believes the situation is, the more resources

they will pour into the housing market.

Wang Ying: “It (the current bubble) is like a dike holding

a flooding river.

All their farmland and crops are protected by the dike.

As they cannot move their farmland, the only thing to do

is to continuously build the dike up to a higher level.”

Eventually, the swelling housing bubble has to burst.

Wang Ying said she does not know when that will happen.

However, once that day comes, it will bring a great disaster

to the CCP’s regime.

Wang Ying: “I think the collapse of China’s house market

is a doom to the party.

Once the housing bubble bursts, the party will no longer

be able to maintain its regime.

All serious problems of the regime have been reflected

in China’s housing market.

Therefore any prediction of when housing bubble

will burst is almost equivalent to talking about

when the entire regime will collapse.

Currently I cannot comment further.”

Gordon G. Chang, famous Chinese-American author,

once said the CCP leaders hate to see any economic decline,

as it makes them feel insecure about their political power.

As they have enough resources and power to affect

the market, they use them to avoid a natural recession.

For the same reason, the market imbalance

keeps heading towards an extreme.

After that imbalance exceeds a certain level,

the unavoidable collapse of the housing market

will finally lead to disastrous consequences

to the entire regime.

Interview & Edit/Qinxue Post-Production/Lizhiyuan