【新唐人2014年02月10日讯】近年来,钢贸商跑路、自杀等恶性事件频频出现。日前,国内媒体发布消息,上海“钢贸大王”肖家守4亿6000多万资产被查封。专家估计,全中国20万家钢贸商中,因资金链断裂等连锁危机,至少有三分之一将出局。

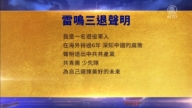

日前,大陆上市公司“新日恒力”发布公告,因金融借款被起诉,公司实际控制人、上海“松江钢材城”董事长——肖家守,4亿6000多万元的资产被查封。

据了解,有多家银行起诉肖家守,其中主要为平安银行、民生银行及工商银行。

而这次银行申请执行查封肖家守资产,据报导,只是肖家守借贷纠纷大规模爆发的开端。起诉肖家守的金融借款纠纷案,已经多达11笔。

肖家守,现任上海松江钢材市场、和苏州长三角钢材市场经营管理公司董事长,也是宁夏“新日恒力”、和上海“新日股权投资”等公司董事长。其中,上海松江钢材市场是全国最大的钢材市场之一,肖家守所代表的“钢贸福建帮”,掌控了华东钢材流通市场的半壁江山。

上世纪90年代中期,肖家守已进入钢贸行业,除了在长三角地区拥有两个钢材交易市场外,他的资产还涉足金融、和地产开发。

有些钢贸商透露,长三角地区,很多中小钢贸商三五结群,通过交换钢材货存,向银行连环担保贷款,再把贷来的资金投到地产和股市里套利,借款黑洞在钢贸圈越滚越大。

2010年后,中共出台地产调控政策,钢价在2011年迎来暴跌,大部分钢贸企业陷入巨大亏损和资金链断裂的境地。2012年起,很多企业被银行连带追诉。进入2013年,钢铁等行业产能严重过剩,钢材卖出“白菜价”,钢贸商老板破产、跑路、自杀的比比皆是。

据《上海证券报》报导,2011年至2013年,银行对钢贸商形成的不良贷款,陆续进入坏账核销阶段。但银行核销不良贷款之后,可能在追债上不像以前逼得那么紧。

《央视》财经评论员牛刀:“往哪儿核销呢,没人负责啊,荒唐的事嘛,它现在很多事情都摀住在那里,最后出事要出大事,东城那个事情也是摀在那里,最后由银行来兜底,不是要命的事啊﹗坏账核销它怎么销啊﹖它这不是个小数字,它是个大数字,它无法销。”

《新华社》报导,估计全国20万家钢贸商中,至少有三分之一将在危机中出局。

大陆企业观察员何军樵:“肖家守的企业的破产倒闭,实际上也是中国经济面临很大的危机的反映,还会有一批由于资金链的断裂,投资回收收不回的情况下会倒闭。第二点,像肖家守这样的商人,借着改革开放这样一个背景,他们都谈不上成熟的企业家,一贯吃惯了政策饭,所以本身也不少不干净的行为。”

《新华社》分析说,钢贸商如今的惨淡局面,根源于金融危机后的信贷大跃进。2008年后,随着4万亿投资盛宴的开启,钢贸商开始大肆炒作钢材。

牛刀:“本来它是没有钱的,按道理,它要刺激经济的话,它可以通过发债的手段,它没有通过发债的手段,而是通过印钞手段,手段本身是错的,然后各级政府部门在银行拿钱,什么抵押品都不要,当时。就是凭着条子,发改委的条子,就在银行贷款,现在无法收拾了,影响了所有的工业。”

肖家守旗下的投资公司——上海“新日”,所持有的“新日恒力”8000万股已被冻结。受此影响,“新日恒力”股价开盘日大跌8.13%。

何军樵:“改革开放三十多年到现在,太子党的企业,很少有遭到如此悲惨的局面,遭到如此悲惨的几乎都是民营企业家,这也是值得深思的,恐怕也有政府背后的深刻的一个意义。”

大陆企业观察人士何军樵表示,所谓的“钢铁大王”,在中共眼里不算什么,因为中国的经济命脉不在他们手上,是在中共政权或太子党的手里。因此,民营企业的死活,对于当局来说,也就无关痛痒了。

采访编辑/刘惠 后制/李智远

Chinese Private Sectors Are at Stake

In recent years incidents of suicide amongst steel trading

businessmen have become frequent.

Xiao Jiashou, China’s steel-trading king, was reported to have

his core assets frozen.

Analysts estimate at least a third of the 200,000 steel trading

businesses in China will be gone because of credit stress.

The Chinese listed company Ningxia Xinri Hengli Steel Co.

was recently prosecuted for bad debts.

The court froze Xiao Jiashou’s stake worth about 460 million

yuan ($75.8 million) at the company.

The freezing is due to a loan dispute with Ping An Bank,

Minsheng Bank, and Industrial and Commercial Bank of China.

Xiao Jiashou’s asset freeze was believed to be just the

beginning of his massive credit loan disputes.

Banks have brought as many as 11 cases against Xiao.

Xiao Jiashou is Chairman of Shanghai Songjiang Steel Market,

Suzhou Yangtze Steel Market, Ningxia Xinri Hengli Steel Co.

and Shanghai Xinri Equity Investment Co.

Among them, Shanghai Songjiang Steel Market is one of the

largest steel markets in China.

The Steel Trade Fujian Gang represented by Xiao Jiashou

controls half of the Eastern China steel market.

Xiao Jiashou entered the steel trade industry in the mid 1990s.

His assets include the two steel markets in the Yangtze River

Delta region, as well as in finance and real estate.

Sources in steel trade revealed that many small and medium

steel traders work in a chain to secure loans from the banks

through the exchange of steel stock.

The loans were then invested in properties and stocks.

The problems of excessive loans to steel makers and traders

have been brewing.

The Chinese Communist Party real estate control policies in

2010 have ushered in the fall of steel prices during 2011.

The steel industry in China has become stranded

in financial crisis.

Since 2012, many lawsuits have been brought against the steel

industry by banks.

Seriously excessive steel has pushed the steel to be sold at the

price of “cabbage” and forced many owners in bankruptcy,

on the run, or suicide in 2013.

According to Shanghai Securities News report, since 2011

the banks have started to write off these account as

uncollectible for the bad loans to steel industry.

Consequently, the banks will not collect credit as harshly

as they used to.

Chopper, CCTV financial commentator: “How to get the

balance? No one will be responsible. This is ridiculous.

Everything is covered until the banks reveal the details.

People will die. How can bad loans be written off?

It is not a small figure. It is huge.

They cannot be written off."

Xinhua News Agency estimated at least one-third of the

200,000 steel trading businesses in China is at stake.

He Junqiao, Chinese enterprises observer: “Xiao Jiashou’s

bankruptcy reflects the financial crisis in China.

The breakage of the loan chains will lead to the failure to

recover the investments for many businessmen.

People like Xiao Jiashou, are not the real entrepreneurs.

They took advantage of the policies in reform and opening,

and have certainly had much misconduct in the process."

Xinhua News Agency analyzed the bleak situation of the

Chinese steel trading business is rooted in massive credit loans

after the financial crisis.

In 2008, the steel trade began to hype the industry with the

CCP’s 4 trillion (US$ 586 billion) stimulus package.

Chopper: “There was no money at the beginning. Ideally,

bonds should be the way to stimulate the economy.

But, instead of issuing bonds, they printed cash, which

was a mistake.

The governments and units took money from the bank.

There was no mortgage, but a note from the National

Development and Reform Commission.

With the note, they got the money from the bank.

That was it and it affected all industries."

Xiao Jiashou’s 80 million stake in Shanghai Xinri freeze has

led to 8.13% stock price fall of Xinri Hengli.

Shanghai Xinri is the largest shareholder of Xinri Hengli.

He Junqiao: “Since the reform and opening, it has always been

the private entrepreneurs being attacked and left with miseries,

rarely the princelings’ businesses.

It is also worth pondering, about the profound influences of

government."

Chinese enterprises observer He Junqiao does not believe the

meaning of so-called “Steel King” to the CCP.

China’s economic lifeline does not lay in their hands

but with the CCP or the princelings.

Therefore, the authorities couldn’t care less about the

life and death of private enterprises.

Interview & Edit/Liuhui Post-Production/Li Zhiyuan